Empower your financial services with DhruveCRM — the intelligent CRM that unifies customer data, automates workflows, and delivers AI-powered insights. Drive growth, compliance, and productivity while putting customers at the heart of every interaction.

Empowering the Banking & Finance Sector

Streamline Customer Relationships and Financial Operations with Intelligent Automation

Multi-Channel Integration

With DhruvCRM, banks can seamlessly connect data from multiple channels — branches, mobile apps, websites, and call centers — into one unified view. By understanding customer preferences and behaviors, DhruvCRM helps you deliver personalized financial solutions, recommend the right products, and ensure a consistent, connected experience across every touchpoint.

Key Features

Lead & Opportunity Management

Capture, qualify, and nurture leads efficiently to boost loan conversions and financial product sales.

Workflow Automation

Simplify repetitive financial processes like approvals, KYC tracking, and loan follow-ups with automated workflows.

Customer 360° View

Get a unified dashboard of client interactions, transactions, and communication history for personalized engagement.

Secure Data Management

Ensure compliance and security with advanced encryption and access controls for sensitive financial data.

Analytics & Reporting

Gain actionable insights through real-time dashboards for portfolio performance, sales forecasting, and branch productivity.

Multi-Channel Communication

Connect with customers through email, SMS, WhatsApp, or call integrations to enhance engagement and response rates.

Engage Customers and Empower Teams with DhruveCRM for Financial Services

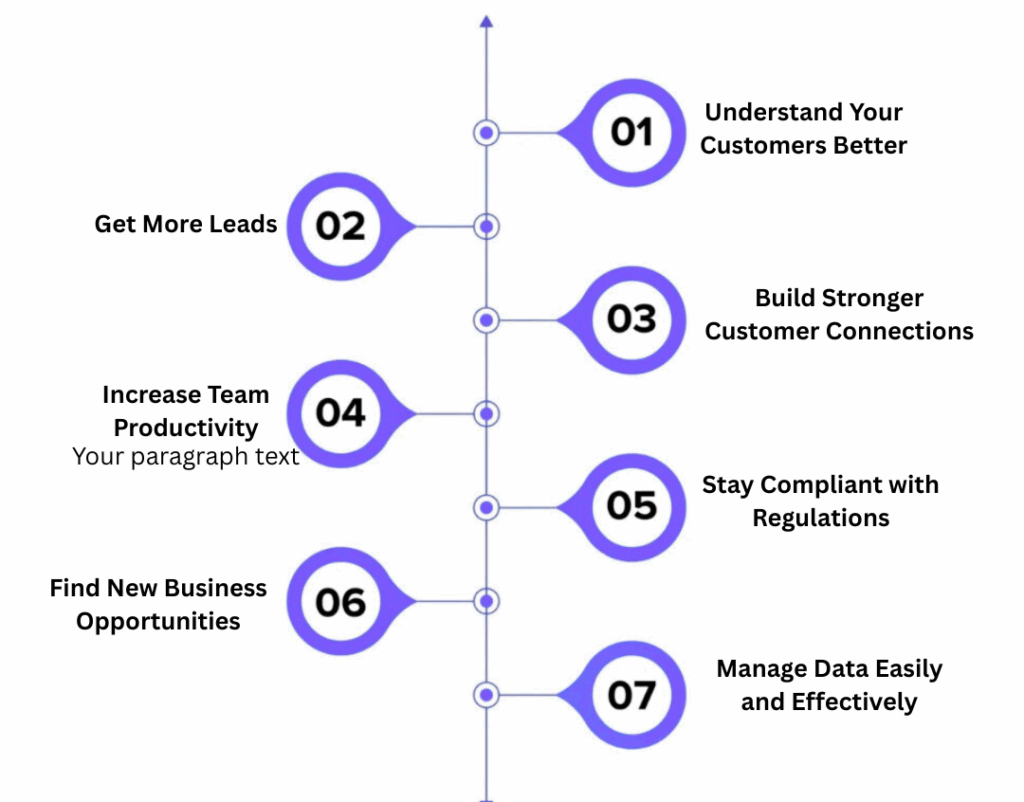

How Banks Benefit from Using CRM

How DhruveCRM Helps

✅ Centralized Data Management

Consolidate customer information for faster, data-driven decisions.

✅ Automated Workflows Streamline KYC, loan processing, and approval cycles.

✅ Omnichannel Engagement

Deliver seamless interactions across digital and offline channels.

✅ Enhanced Security & Compliance

Maintain data integrity with role-based access and audit trails.

Why Choose DhruveCRM for Banking & Finance

Enhances customer experience through personalized and timely engagement.

Improves operational efficiency with automated and paperless workflows.

Ensures compliance with financial data protection and audit-ready reporting.

Boosts revenue growth by optimizing cross-sell and upsell opportunities.

Banking & Finance CRM – Frequently Asked Questions

How does DhruveCRM improve customer service in banking?

DhruveCRM provides a 360° view of every customer — including their accounts, transactions, and communication history — enabling faster query resolution, personalized offers, and improved relationship management.

What is DhruveCRM for Banking and Finance?

DhruveCRM is a specialized Customer Relationship Management platform designed for banks, NBFCs, and financial institutions. It streamlines operations, automates workflows, enhances compliance, and helps deliver superior customer experiences through data-driven insights.

Is DhruveCRM secure and compliant for financial institutions?

Absolutely. DhruveCRM ensures end-to-end data security through encryption, role-based access, and audit trails. It supports compliance with major financial regulations and data protection standards.

Can DhruveCRM automate banking workflows like loan processing and KYC?

Yes. DhruveCRM automates critical workflows such as lead tracking, loan approvals, document verification, and KYC updates, reducing manual work and improving operational speed and accuracy.

Is DhruveCRM suitable for both small and large financial organizations?

Yes. DhruveCRM’s scalable architecture supports both small NBFCs and large banks, allowing organizations to start small and expand features as their business grows.

How does DhruveCRM help financial teams make better decisions?

With advanced analytics and real-time dashboards, DhruveCRM provides deep insights into sales performance, portfolio health, and customer trends — enabling smarter, faster decision-making.

Can DhruveCRM integrate with existing banking or ERP systems?

Yes. DhruveCRM easily integrates with core banking, ERP, and communication systems, ensuring smooth data exchange and a unified view of operations across departments.

At DhruvCRM Software Pvt. Ltd., technology drives everything we build but it’s our people who create the real impact.

We bring together a team of innovators, problem-solvers, and industry experts who combine deep technical expertise with a customer-first, product-driven mindset to deliver intelligent and connected enterprise solutions.

Connect With Us

DhruvCRM Software Pvt Ltd

1304-1306,Maruti Millennium Tower, Nanaware Chauk, Baner Highway,Baner, Pune. Maharashtra (India) 411045

Ph: +91 8421015343 , +91 7722011669

Email: md@dhruvcrm.com